He said there has been widespread adoption of technological inputs at corporates in the face of the pandemic, with both board meets and also annual general meetings going virtual.

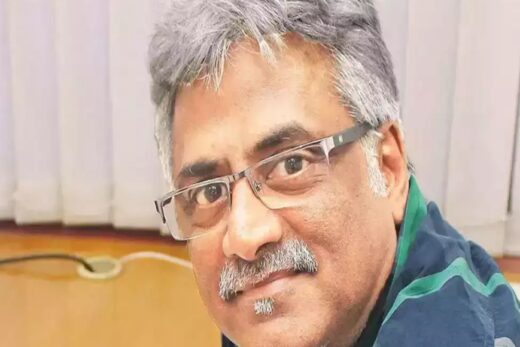

“However, virtual meetings have given rise to new concerns which were earlier not there in physical meetings,” Tyagi said, addressing an event at the Sebi-promoted National Institute of Securities Markets virtually.

These include “whether confidentiality and security concerns are adequately addressed in virtual board meetings”, Tyagi said, adding that such issues need greater study if such virtual meetings are to become a regular feature in the future.

Other concerns specified by the Sebi chief included if investor voices are adequately heard during virtual shareholder meetings and whether shareholders have sufficient opportunity to pose questions to the management at such meets.

Earlier, Tyagi said corporates have adopted a slew of changes in their functioning following the pandemic and technology played an important role in facilitating relatively smooth operations through interventions like work from home and video conferences.

“It is more than likely that many of these trends which were induced by the pandemic might stay even after the pandemic dissipates,” he added.