Payments Bank has over 5.5 crore engaged users across its operations, the statement added.

The interest rate is at 2.5 per cent per annum for a deposit up to Rs 1 lakh.

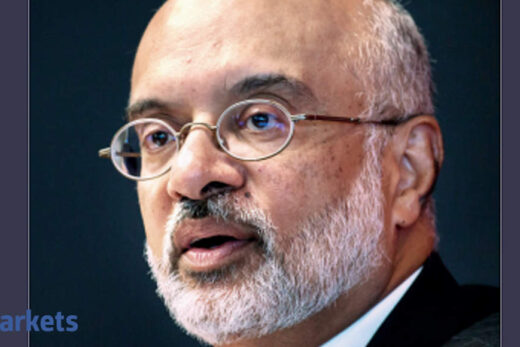

Announcing the higher interest rate on savings account deposits of over Rs 1 lakh, Anubrata Biswas, CEO of Airtel Payments Bank, said, “RBI’s increased savings deposit ceiling is a major milestone for payments banks as this was a key ask from customers”.

With an “attractive” interest rate on deposit sums above one lakh, Airtel Payments Bank is making banking proposition even more rewarding, Biswas added.

“Our unmatched footprint of 5,00,000 banking points and a global first secure and simple experience delivered digitally, Airtel Payments Bank offers a market-leading proposition for both the urban digital and the rural underbanked customer,” Biswas pointed out.

The new interest rate regime is an important addition to the bank’s suite of solutions.

Customers can open an Airtel Payments Bank account within minutes with a video call from the Airtel Thanks app.

The bank offers a digital savings account – Rewards123, which offers more value to customers when they transact digitally using the account.