Following the development, shares of the Anil Agarwal-led firm traded marginally lower at Rs 255.80 in Tuesday’s trade. The adjustment in weightage took place on Tuesday for FTSE, and on Wednesday for MSCI. The announcements came after the company reported latest shareholding data for the quarter ended March 31, 2021.

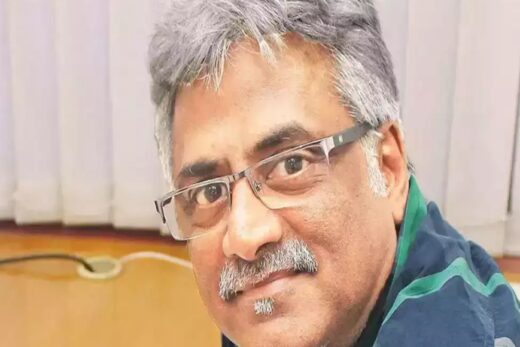

Metals and mining magnate Anil Agarwal has raised his stake in the flagship firm to 65.18 per cent from 55.1 per cent through an open offer during the March quarter.

Vedanta Resources, the parent company of Vedanta, acquired 37.42 crore shares of Vedanta through the recently concluded voluntary open offer. Vedanta Resources had launched the offer to buy up to 65.1 crore shares (or 17.5 per cent equity) at Rs 235 a share, but received bids for only 58 per cent.

Various funds track the passive indices of FTSE and MSCI. A lower weightage on these indices is likely to lead to some selling by index funds on the counter.

Shares of Vedanta have been an outperformer on the bourses. The stock is up 190 per cent in the last six months from Rs 91.9 to hit a 52-week high of Rs 266.25 on April 30, 2021. The scrip has soared over 50 per cent in the past three months.