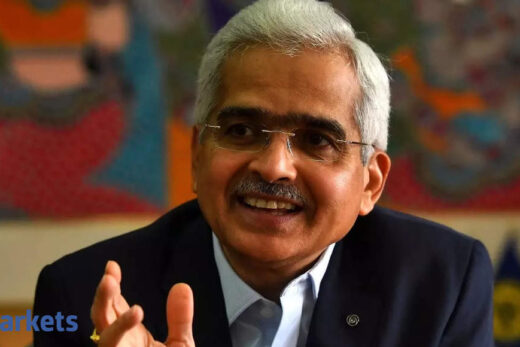

The governor’s comments were published in the latest edition of the RBI’s Financial Stability Report, released earlier in the day.

“As this issue of the Financial Stability Report highlights, the dent on balance sheets and performance of financial institutions in India has been much less than what was projected earlier, although a clearer picture will emerge as the effects of regulatory reliefs fully work their way through,” Das said.

The RBI Financial Stability Report showed a more benign increase in bad loans at scheduled commercial banks in the country. According to RBI’s stress test, gross non-performing loans could rise to 9.8 per cent by March 2022 from 7.48 per cent in March 2021.

In the January edition of the report, the central bank had project GNPAs to rise to 13.5 per cent by September 2021 and to 14.8 per cent in the worst case scenario.

“With the scent of recovery, global financial markets are upbeat on reflation trade. Domestic financial

markets are also boosted by the strengthening signs of the pandemic’s abatement, the growing pace and breadth of the vaccination drive and renewed hopes of the economy clawing back lost ground as it unlocks,” Das said.

Das, however, warned that new risks are emerging on the horizon including the still nascent and mending state of the upturn, vulnerable as it is to shocks and future waves of the pandemic, international commodity prices and inflationary pressures, global spillovers amid high uncertainty, and rising incidence of data breaches and cyber attacks.

“Sustained policy support accompanied by further fortification of capital and liquidity buffers by financial entities remains vital,” Das said.