RBI allows retail direct gilt accounts

Stage set for the country’s biggest LIC IPO

Realty stocks look set for a solid run-up

CEAT set to enter a fast lane

Now lemme give you a quick glance on the state of the markets.

Dalal Street looked headed for a solid start this morning, as Nifty futures traded some 111 points higher on the Singapore Exchange at 7 hours (IST). Other Asian markets opened firm. Equity benchmarks rose in Japan and South Korea, with more subdued gains in Australia. Wall Street’s key indices closed at their highest levels ever on Monday, lifted by Tesla and bank stocks as investors eyed the start of the second quarter earnings season.

Elsewhere, US Treasuries traded steady. The dollar dipped against most major peers. Oil price rose, recovering from the previous day’s drop, on expectations of further declines in US crude inventories.

That said, here’s what is making news?

Realty stocks might be on the cusp of a sharp run-up with the Nifty Realty index giving a breakout on Monday after 10 years of moving in a tight band. Analysts are betting on companies with stronger balance sheets such as Godrej Properties, Prestige Estates and DLF among others, which seem to be better poised to benefit from the likely rebound in the sector’s prospects. The Nifty Realty Index rose 3.6% on Monday to its highest level since 2011.

The stage is set for the country’s biggest IPO with the Union Cabinet approving the share sale of the state-run insurance behemoth LIC. Agency reports said the Cabinet Committee on Economic Affairs, which met last week, had cleared the IPO of LIC. While no official announcement has been made about the approval, sources said the issue was part of the agenda for the Cabinet meeting. The report said that a panel headed by finance minister Nirmala Sitharaman will decide on the exact amount of stake dilution.

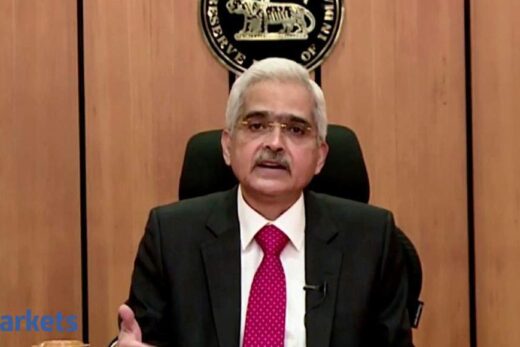

RBI has allowed retail investors to open accounts with the central bank through which they can purchase government bonds in auctions and maintain them in demat form. This was first announced by RBI governor Shaktikanta Das in February this year. He had pointed out that only a handful of other countries like the US and Brazil had this facility. Under the scheme announced by RBI on Monday, investors can open a ‘Retail Direct Gilt Account’ through an online portal.

The stock of tyre maker CEAT has been in a tight range over the past three months following raw material inflation amid a challenging demand scenario due to the pandemic. To protect profitability, the company has raised product prices and has plans to reduce costs through higher process efficiency. Analysts said this together with improving replacement and export volume and a focus on increasing market share in key categories is likely to support the stock in the medium term.

LASTLY,

Most brokerages have maintained a bearish view on Avenue Supermarts as its June quarter (Q1) earnings missed consensus estimates owing to a sharp decline in gross margins. They see limited triggers for the stock in the near term and expect a demand recovery only after the September quarter. Some said valuation is expensive and limits the possibility of having a constructive view on the stock.

NOW Before I go, here is a look at some of the stocks buzzing this morning…

The market capitalisation of Adani Group’s listed entities crossed $100 billion in the first week of FY22, the conglomerate’s chairman Gautam Adani said in its annual shareholders’ meeting.

Telecom operator Bharti Airtel recorded a speed of over 1 Gigabit per second during a 5G field trial in Mumbai using Finnish firm Nokia’s network gear, according to sources.

Ravi Nedungadi, the only remaining nominee of Vijay Mallya on the board of United Breweries, will step down at the company’s annual general meeting on July 29.

Realty developer Sunteck Realty has reported 74% on-year rise in bookings at Rs 176 crore for the quarter ended June led by the performance of its mid-income and affordable housing projects.

India Glycols is looking to leverage its value-added chemicals businesses and wean away from its commoditised products portfolio in a bid to shore up margins and cut the impact of commodity cycles.

Do also check out over two dozen stock recommendations for today’s trade from top analysts on ETMarkets.com.

That’s it for now. Stay put with us for all the market news through the day. Happy investing