NEW DELHI: Government bonds gained at the open on Thursday as a decline in global crude oil prices and US Treasury yields lifted domestic market sentiments, treasury officials said.

Yield on the most traded five-year 5.63% 2026 bond was last at 5.66%, three basis points lower than the previous close. Bond yields and prices move inversely. The 10-year benchmark 6.10% 2031 bond was yet to be traded at the time of publishing this story.

Crude oil futures for August delivery on the New York Mercantile Exchange settled $2.12 lower at $73.13 per barrel on Wednesday due to speculation of a likely increase in production by Saudi Arabia and the United Arab Emirates, reports said.

Lower oil prices have a softening effect on domestic inflation, providing more legroom for the Reserve Bank of India to ease interest rates.

Despite a crash in economic growth caused by the pandemic, the central bank has been compelled to maintain the repo rate at 4% for more than a year now due to elevated domestic inflation.

High inflation erodes the fixed returns offered by government bonds and typically prompts investors to demand higher returns.

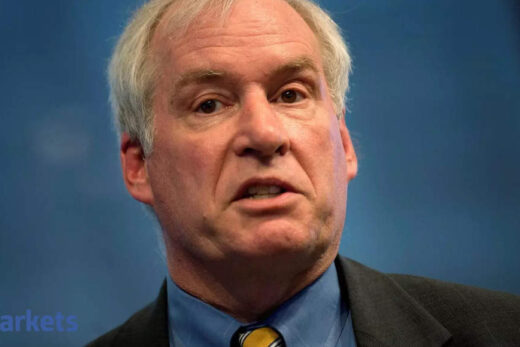

Comments by US Federal Reserve Chair Jerome Powell also buoyed the bond market’s mood.

In a testimony to the US Congress, Powell said that inflation would remain high in the US for some months before cooling, but that the Fed would continue to provide monetary policy support. The comments eased concern of a faster-than-expected policy normalisation and reduction of asset purchases in the world’s largest economy.

US Treasury yields ticked lower today, with yield on the 10-year Treasury note last trading two basis points lower at 1.33%.

A fall in US bond yields increases the appeal of relatively higher-yielding fixed-income instruments in riskier emerging markets such as India.

However, gains in domestic bonds were capped ahead of a primary auction worth Rs 32,000 crore on Friday.

Traders also awaited the details of the RBI’s next round of open market bond purchases worth Rs 20,000 crore on July 22.

Expectation of the central bank including liquid securities as candidates for the bond purchases lent support to prices, treasury officials said.

“The Fed’s view and the sharp fall in oil prices are the main triggers for the market,” a treasury official at a large foreign bank said on condition of anonymity.

“But the very fact that the 10-year benchmark has not yet opened shows the difficulty in its yield falling below 6.10% and going into a premium. For that, RBI will have to include the liquid 5-year and 14-year bonds in the next OMO. That is the expectation,” he added.