FUNDAMENTALS

Spot gold was flat at $1,787.40 per ounce, as of 0114 GMT, after having recorded a weekly decline of 2.1%.

US gold futures fell 0.3% to $1,786.90.

The dollar index slightly strengthened in the Asian trade, having delivered a 0.6% weekly gain, making gold more expensive for holders of other currencies.

Data on Friday showed US producer prices increased solidly in August, leading to the biggest annual gain in nearly 11 years.

The reading sent the benchmark US 10-year Treasury yield higher.

While some investors view gold as a hedge against higher inflation, higher yields translate into higher opportunity cost for holding non-interest bearing bullion.

Cleveland Fed President Loretta Mester said on Friday that she would still like the central bank to begin tapering asset purchases this year, joining the chorus of policymakers making it clear that their plans to begin scaling back support were not derailed by weaker jobs growth in August.

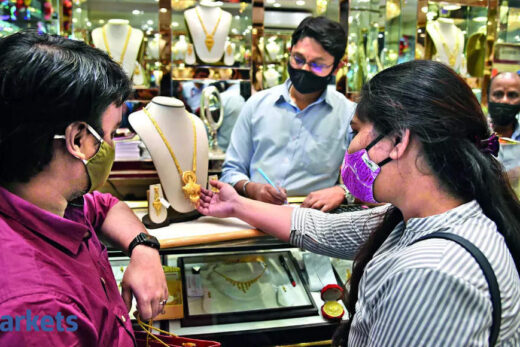

Physical gold demand in India was subdued last week despite a correction in bullion prices, while consumers in most other Asian hubs also stayed on the sidelines as they hoped for a clearer trend in global prices.

Speculators cut their net long positions in COMEX gold by 15,324 contracts to 83,540 in week ended Sept. 7, data from the US Commodity Futures Trading Commission showed.

Platinum eased 0.1% to $955.01 per ounce and touched its lowest level since November 2020.

Palladium hit its lowest level since August 2020, but recovered lost ground to trade up 0.3% at $2,145.03.

Silver was flat at $23.72.