The company’s board will take a call on converting interest on dues into government equity, which may lead to a maximum 2-3% dilution, he said.

Further, Mittal said, he had reached out to Vodafone Group chief executive Nick Read, and told him that “it is time for Vodafone and Mr (Kumar Mangalam) Birla to step up their contribution into the company”. This is really the time for them to contribute their money, their resources, to revive the beleaguered Vodafone Idea, he said.

UK’s Vodafone Group and the Aditya Birla Group, parents of Vodafone Idea, have so far refused to invest fresh equity into the cash-starved telco.

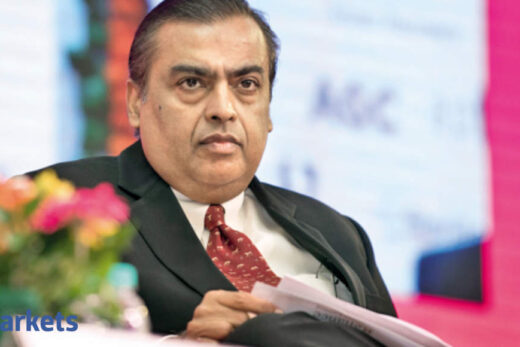

Mittal added that will soon speak to Mukesh Ambani, chairman of Reliance Industries that owns rival Jio, and discuss cooperation in areas such as sharing of infrastructure including fibre, data centres and market practices.

“Tariff is never an area where we can sit together and talk, neither we should but there are market practices … the structure of commissions in the marketplace, the dealer margins,” Mittal said at a media roundtable.

He was referring to a question if he will speak to Ambani about raising prices as an industry. Mittal though added that regulatory intervention on setting a floor price was not necessary, marking a change in stance for the telecom operator.

“There is a possibility for this industry to heal. This industry has seen too much bloodshed. I was happy to hear Mukesh Ambani say that it is time for the industry to come together … Responding to his statement, I would say, time has come for all of us – the 3-plus-1 operators – to close ranks and start together, rather than being fierce competitors,” he said, adding: “While we will compete in the marketplace, we should build the ecosystem.”

Mittal was speaking a day after the government announced a four-year moratorium on AGR and spectrum payments, approved redefining AGR to exclude ‘non-telecom’ items and cut the spectrum usage charge to zero — both prospectively. The steps are expected to help cash strapped Vodafone Idea survive, say analysts.

Mittal described the reforms as “seminal” and a “game changer” and said the telecom minister has indicated that more reforms are on the anvil.

Other key decisions by the government announced on Wednesday include giving operators the option to pay the interest amount on the arrears due to the deferment of statutory payment “by way of equity”. The Centre also has the option of converting operators’ dues owing to the deferred payment into equity at the end of the moratorium period. Guidelines for this will be finalised by the ministry of finance.

“(Company decision on) equity for interest will go to the board … we need to see whether this is an upfront equity conversion after four years or whether we will be able to do it every year. Moratorium we will take as the cash flows will get redirected towards building networks and ensuring that you know all the needs of the company are met,” Mittal said.

Airtel will get a cash flow relief of about Rs 35,000-40,000 crore, he said. “As a result, a lot of public market debt can be reduced. We will be able to invest the savings in cash flow into the industry and invest in technology. I can assure you the savings on the cash flow will not go into the dividend.”

On tariff hikes, Mittal said Airtel may take the lead “in some areas” and added that the industry can no longer afford to cut down each other for market share and should instead look to build a sustainable business. He expects average revenue per user (ARPU) to touch Rs200 by the end of FY22.

For Airtel, the ARPU was Rs146 for the quarter ended June 30. For Jio, it was Rs 138.20 and for Vodafone Idea, Rs104.

“We in our businesses need to be responsible. I will play my own part, others have to play their part. How long can you keep on having an industry with an unsustainable structure because you cannot keep going back to the government all the time,” Mittal said.

He added that India doesn’t need a floor for pricing.

All three private telcos, including Airtel and primarily Vodafone Idea, had previously called on the telecom regulator to introduce a floor price for data services.

“I don’t think regulatory intervention in tariffs is something I would subscribe to. India has lived its policy of forbearance for a long time. Customers have enjoyed the benefit of fierce competition in this country, people are enjoying data,” Mittal said.

He added that more regulatory action needs to be taken on reducing the base price of 5G airwaves and also of 700 MHz band, besides on reducing levies such as license fees and taxes.

He said the government needs to amend the Indian Telegraph Act of 1885 to conform with the changing times.

“…we will reach out to the government and contribute our inputs to the government in what we can change. (Too much) litigation is one area that needs to be worked out.”

Mittal, who will turn 64 next month, said after retirement, he would like to do something in the infrastructure space.

“It has got to be something in India. A lot of conversation is going on in the infrastructure pipeline projects. Will focus on something, I have to do something new. Pick up a strong big bet and hopefully give time to that,” Mittal added.