bridge between the depositors and borrowers.

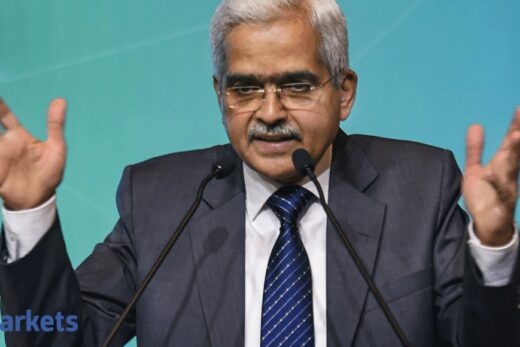

Without naming the Google and Equitas tie up to garner deposits, T Rabi Sankar, RBI deputy governor while speaking at the Global FinTech Fest also said that entities other than banks are not allowed to directly deal in deposits.

“Banks are uniquely placed to provide this service because they can create money and credit and thereby act as liquidity providers to the economy,” said T Rabi Sankar, deputy governor, RBI.

“Any fintech entity that provides such liquidity services is effectively functioning as a bank and therefore should be subjected to the same legal, regulatory, supervisory regime that a bank is subjected to. This is one reason why in almost all countries, entities other than banks are not allowed to directly deal in deposit or deposit-like money.”

Sankar also said FinTech’s should be considered and partners for financial institutions.

“The ideal approach is for FinTech companies to be considered as enablers and partners by banks or other financial institutions. Competition for banks comes not from FinTech firms but from other banks which leverage FinTech better,” the deputy governor.

Speaking on the need to regulate FinTech players, Sankar said that regulation around fintech should be more entity-based than activity-based,

“The approach to regulation also needs to adapt to the type of entity being regulated,” he said. “While similar activities should attract uniform regulation in most cases, such activity based regulation might be less effective than entity-based regulation when one is dealing with financial activities by big-tech firms.”

Sankar also pointed out that cyber-security

risks are likely to overshadow financial risks for all. The deputy governor also highlighted that countries need to overcome the legislative and regulatory deficits in dealing with concerns surrounding privacy, safety and monetisation of data.

Sankar also said regulations pertaining to data issues needs to adapt to a world where boundaries between financial and non-financial firms is getting increasingly blurred.

“In many ways, regulation is the process of slowing down continuously evolving value chains so that legislation gets time to catch up,” said the deputy governor.

“Slowing down the process of change can attract criticism that the regulator is stifling innovation, but that is often the best way to protect customers,” Rabi Sankar said in his speech.