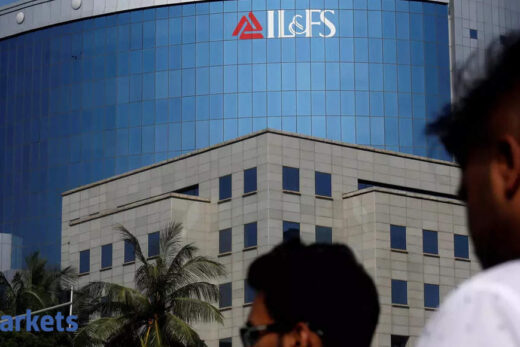

The regulator was quite annoyed with repeated violations of prudential norms, including income recognition, asset classification and provisioning (IRACP), ever-greening of loans and deterioration of corporate governance standards.

The group also remained non-compliant with regulatory directions over the past one year, forcing the Reserve

(RBI) to put the companies under administration. RBI and Srei did not immediately reply to ET’s queries.

“SEFL has remained non-compliant with RBI regulations and supervisory instructions. Despite continuous engagement and follow up by the Reserve Bank, SEFL has failed to take corrective action on governance, systems and controls, compliance etc,” RBI said in its October 1 order superseding the two boards. The order came three days before the administration announcement.

ET has reviewed a copy of the order.

The regulator was also annoyed due to the fact that Srei Infrastructure Finance had in October 2019 transferred its businesses, assets and liabilities to SEFL by way of a slump sale despite objections from a majority of lenders.

RBI had found that SEFL’s capital adequacy turned negative (-3.4%) as on March 31, 2020, as against the prudential norm of 15%. Its non- adherence to IRACP norms resulted in huge divergence of major financial parameters between what the company had reported and what the RBI’s inspection team had assessed.

The Srei Group, on the other hand, had maintained that its extreme financial ill-health was due to the cash flow disruptions after the Covid-19 pandemic-led stress on its borrowers. But the rot had set in much before, the RBI report suggested.

RBI had conducted a special audit of both SIFL and SEFL between November 2020 and January 2021.

The report revealed that that SEFL disbursed loans to certain borrowers only to get them back on the same day or dates close to the disbursement dates, indicating ever-greening of loans, which is a violation of norms.

RBI is now making preparations to refer SIFL and SEFL to the bankruptcy court to recover the dues of the creditors, estimated at Rs 28,000 crore.

Meanwhile, the Bombay High Court on Thursday dismissed Srei promoter Hemant Kanoria’s writ petition against RBI’s move to supersede the boards of the two companies.