The rupee on Friday settled at 74.89/$1 as against 74.8600 per US dollar on Thursday. The partially convertible rupee had started the day at 74.81/$1 and then moved in a range of 74.69/$1 to 74.94/$1.

The rupee had strengthened in early trade because of an overnight fall in crude oil prices; the first fall in the price of the commodity after six straight days of gains.

Crude oil for December delivery on the New York Mercantile Exchange declined $0.92 or 1.1 per cent on Thursday to settle at $82.50 per barrel. Brent crude, the global benchmark also fell, with the December contract closing $1.21 lower at $86.41 per barrel.

International oil prices have surged in October, with Brent prices climbing to over-three-year highs due to concerns over global demand outstripping supply, especially in the midst of a shortage in coal and natural gas.

Given that India is the world’s third largest importer and consumer of crude oil, the hardening in price of the commodity has raised concerns of higher domestic inflation and a worsening trade deficit.

The domestic currency was, however, spared more damage Friday as the Dollar Index, which had strengthened sharply earlier in the day, was off its highs.

After touching a high of 93.79 earlier in the day, the dollar index, which measures the US currency against a basket of six major rival currencies, fell to 93.61.

“The USDINR spot has been on a bearish note this week tracking the fall in dollar index and higher risk appetite. The consolidation may continue even next week as the focus will be on tonight’s US flash PMI data, Reuters expect flash PMI to be mixed. But if next week’s US PCE data shows price growth being steady, then it will advocate that inflation is transitory, limiting any rally in DXY. The USDINR ATM Volatility has been below 5% this week, and the option max pain is at 74.50 strike. So even next week we expect the spot to oscillate in between 74.50-75.25. A break of 74.50 may push the spot to 74.10-74 zone,”

wrote.

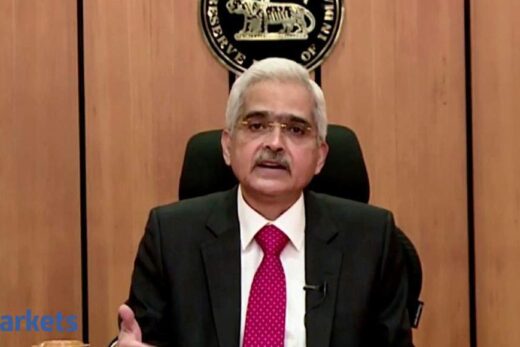

Government bond yields rose today, with yield on the 10-year benchmark 6.10 per cent 2031 paper settling 2 basis points higher at 6.36 per cent, as traders were left disappointed with the fact that the Reserve Bank of India did not announce a fresh round of open market bond purchases, especially after a recent bout of volatility in the market.

Traders also reduced exposure on their portfolios ahead of the releases of the minutes of the Monetary Policy Committee’s Oct 5-8 meeting, due later on Friday.