At present, there are a limited number of players that allow interoperability as per the RBI. As a result, in the majority of cases, money kept in a wallet can only be transferred if it is on the same platform, say Paytm to Paytm or PhonePe to PhonePe. Though you can transfer money from your wallet usually linked to a bank account through UPI, it will work like a wallet-to-bank or bank-to-wallet or bank-to-bank transfer. Once the RBI’s interoperability proposal is put in place, then you can transfer money across different wallets. Say a Paytm user can transfer money to a PhonePe wallet user.

According to the RBI’s Statement on Developmental and Regulatory Policies:

To promote optimal utilisation of payment instruments (like cards, wallets etc.), and given the constraint of scarce acceptance infrastructure (like PoS devices, ATMs, QR codes, bill-payment touch points, etc.), Reserve Bank of India has been stressing on the benefits of interoperability amongst the issuing and acquiring entities alike, banks or non-banks. The Master Direction on Issuance and Operation of PPIs dated October 11, 2017 laid down a road-map for a phased implementation of interoperability amongst PPIs issued by banks and non-banks. Thereafter, the guidelines issued in October 2018 enabled interoperability, albeit on a voluntary basis, insofar as the PPIs were full-KYC (they met all Know Your Customer requirements). Despite a passage of two years, migration towards full-KYC PPIs, and therefore interoperability, is not significant. It is, therefore, proposed to make interoperability mandatory for full-KYC PPIs and for all acceptance infrastructure.

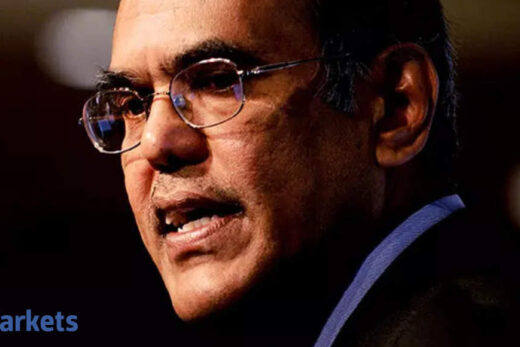

To enhance the compliance related to anti-money laundering in prepaid payment instruments, the central bank has also proposed to enhance the outstanding balance from Rs 1 lakh to Rs 2 lakh for full KYC compliant accounts. “To incentivise the migration of PPIs to full-KYC, it is proposed to increase the limit of outstanding balance in such PPIs from the current level of Rs 1 lakh to Rs 2 lakh” said Shaktikanta Das, Governor, RBI while announcing the monetary policy. The central bank will issue the necessary instructions separately.