Tracy: OK. Just one more, but on a day like today, when, you know, Elon Musk tweeted, Bitcoin fell 16%. Although, you know, as we’re recording this, it’s pared some of those losses, but all the crypto coins, all the crypto-related stocks are all falling. What was today like for you? Like what did your yield-farming portfolio look like?

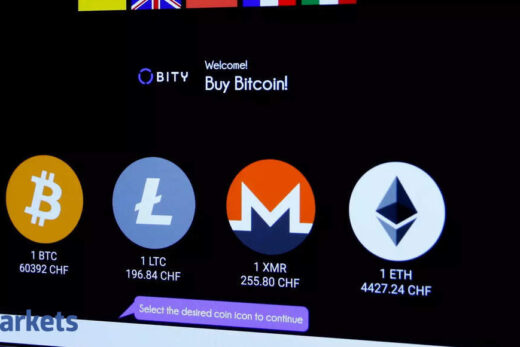

Aaron: You know, I honestly didn’t even check like most of this yield stuff, just kind of happening in the background, I’ll look and see how much I’ve made, but I’m looking more at the prices of the tokens than yields. I think that there are people who are just seeking yield out there, but those are people who have a lot more capital to start with than I do and are, like, not wanting to risk it, but want to just earn yield on like stable coins. I’m primarily holding Ethereum and other DeFi tokens. So when I saw that I actually was happy because I’m in Ethereum. I’m a true believer. And I believe that Ethereum will pass Bitcoin at some point. And I am fine with accelerating that if it can pass Bitcoin by going up or by Bitcoin going down. And I love the hostility and the space between the two camps. It’s getting ugly out there.

So basically a couple of weeks ago, when Elon Musk went after Bitcoin and tanked the entire market, the reaction among (at least some) Ethereans was that it was good, because Ethereum has a plan to go green (which Matt Leising wrote about today) and Bitcoin will always be proof of work (which is electricity intensive). So if proof of work becomes vilified, then that’s good for Ethereum in the long run, even if in the short run they all collapse. That’s the theory anyway.

Except now Musk is sounding warm to Bitcoin again, talking about his discussions with miners regarding renewable-energy mining in North America. Actually, the full context is that Michael Saylor, the Microstrategy’s chief executive officer, is convening a meeting between Musk and various miners. And note he specifically cites ESG considerations in the second tweet:

So now you have at least some Bitcoin industry leaders trying to make a point of sounding “green” or ESG-friendly.

What’s interesting, too, is that while Bitcoin leaders start to tout their green bonafides, the Ethereum world is starting to sound like hard-money types.

A lot of people are talking about this Packy McCormick blog post about upcoming changes to the Ethereum protocol, one of which includes a plan to slowly shrink the available number of coins out there.

Substance aside, this is part of the new Ethereum rhetoric:

But EIP 1559 and Eth2 flip that. With Eth2, new issuance to reward validators is expected to drop dramatically versus Proof of Work rewards. With EIP 1559, by burning ETH in every transaction, assuming a conservative amount of daily transaction fees and that 70% of the gas fee is burnt and 30% is sent as a tip, then more ETH will be burnt than issued every day. Together, the supply of ETH will actually begin decreasing after EIP 1559 and the Eth2 merge. It’s better than sound money. It’s Ultra Sound Money.

So you have Michael Saylor talking about ESG, and you have Ethereum bulls talking about “Ultra Sound Money.” Not sure what it means, but it sounds like the End Times.

Meanwhile, both Bitcoin and Ethereum are surging today after a horrible weekend. So for all of the ostensible disputes between the two camps, they still trade more or less in unison.