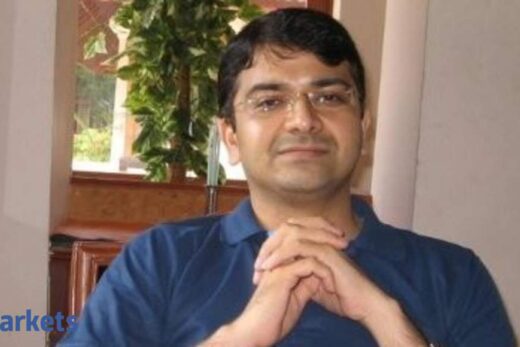

Parekh took over as the CEO of Infosys in January 2018 after the tumultuous exit of former CEO Vishal Sikka and the re-entry of Nandan Nilekani as non-executive chairman of the company.

The company reported a 5.5 per cent sequential, and 12.3 per cent year-on-year, growth in consolidated revenues in the December quarter, which beat analysts’ expectations. The growth was led by strong deal wins for the company and higher utilisation of employees during the quarter.

“The Infosys team has delivered another quarter of excellent results. Execution of client-relevant strategy focused on digital transformation continues to drive superior growth, well ahead of the industry,” Parekh said in a post-earnings statement.

Analysts believe that the strong revenue guidance by the company should provide more legs to the stupendous rally of the stock in the past year. “Investors are now willing to value a company like Infosys at more than 30 times one-year (forward) earnings because it offers long-term earnings stability,” said a head of research of a city-based brokerage firm.

Here are the some of the key takeaways from the IT behemoth’s Q3 earnings:

Growth optimism

If Tata Consultancy Services raised the temperature by suggesting that the company’s revenue could grow in double-digit in 2021-22, Infosys tried to match that by suggesting that its revenues in the current financial year will now grow at 4.5-5.0 per cent as against 2.0-3.0 per cent guidance given earlier. Analysts said that the hike in the company’s revenue growth guidance was better than anticipated.

Deal wins momentum strong

Infosys said that the momentum in the market remains strong and that it continued to gain market share in the IT services industry. The company clocked deal wins worth $7.13 billion for the December quarter, the highest in its history. Infosys said that deal win momentum is coming in the financial services vertical in the US and expect the same to pick up in Europe.

Digital services vertical comes off age

At the beginning of his tenure as the chief executive officer, Salil Parekh had indicated that digital services will play a greater role in the company’s performance. In the December quarter, revenues from digital services exceeded 50 per cent of the company’s overall sales, which reflected the transformation of the company under Parikh. Digital services revenues grew 31.3 per cent on a year-on-year basis in December quarter.

Margin tad disappointing

The Bengaluru-based company reported a consolidated operating margin of 25.4 per cent, a year-on-year rise of 350 basis points, but in-line with ET Now estimates. Investors, however, may look at the increase in the company’s margin guidance to 24.0-24.5 per cent from 23.0-24.0 per cent.

Pricing stable

Infosys’ CEO said that the pricing environment remained stable and that the company did not see any negative discussion on pricing with clients. In the digital services deal, Parekh said that the company has seen benefits in terms of value during deal negotiations.

Aggressive hearing ahead

Infosys said that it was not comfortable with the sharp jump in employee utilisation levels seen in the December quarter. The staff utilisation including trainees stood at 82.3 per cent in October-December, sharply higher than 80.6 per cent in the September quarter. The company said that it will look at aggressive hiring going ahead to meet the rising demand for IT services.

Valuations may have room for upside

Infosys is currently valued at 27 times one-year forward earnings as against industry leader TCS’ metric of 31 times one-year forward earnings. Analysts believe that the strong commentary and revenue growth visibility could lead to more re-rating ahead.