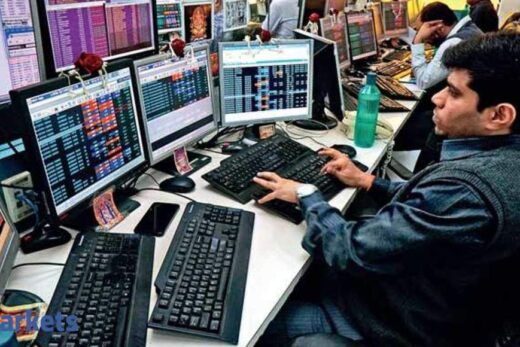

As the broader market continues to outshine the benchmark indices, the rally in midcap IT stocks is showing no signs of slowing down. The bounce is interesting because they have left behind the Big Four of Indian IT — Infosys, TCS, Wipro and HCL Tech. Sample this: In the last one month, India’s largest IT company TCS has delivered a negative return of 2.6%, while a much smaller Happiest Minds Technologies gained 63%.

Is it a sign of a bubble building up in the midcap IT space or is the investor enthusiasm justified? In today’s special podcast with independent market expert Rajiv Nagpal, we try to understand the best way to deal with IT stocks.

Listen in.

Welcome to the show Mr Nagpal.

1) Can you decode the reasons behind the rally in midcap IT stocks? Is it because the growth rate of midcap IT companies is higher due to the base effect? Or is it about their agility in adapting to the digital demand in a post-Covid world?

2) Looking at the premium valuation of midcap IT stocks, do you think the rally is sustainable?

3) If the big is becoming bigger because of the pandemic, then why are the Big Four IT stocks left behind?

4) Do you think largecap IT stocks offer more margin of safety to investors? Is the downside risk less and upside potential reasonably high there?

Thank you Mr Nagpal. That’s all in today’s special podcast. But do keep checking this space for more such interesting content. Good bye!