They include setting up of an integrated Ombudsman platform, a 24*7 customer helpline to address payment systems related queries and outsourcing norms for payment companies availing services of third-party players for stricter monitoring.

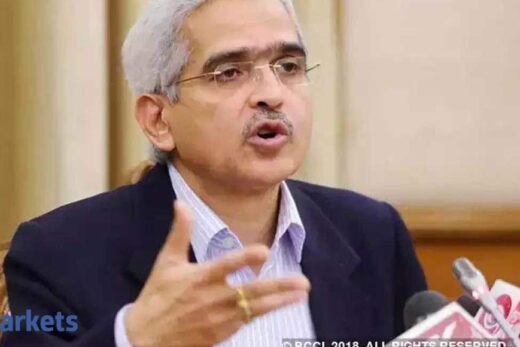

The central bank governor Shaktikanta Das announced these measures on Friday during the Monetary Policy Committee (MPC) address to strengthen and deepen India’s digital payments network to gradually replace cash-based transactions in the country.

Das said that the central bank is working on integrating the ombudsman mechanism for customer grievance redressal for banks, non-banking finance companies and other payment instruments such as mobile wallets and prepaid cards into a ‘One Nation One Ombudsman’ approach.

At present, the framework consists of three separate schemes for banks, NBFCs and non-bank prepaid payment issuers (PPIs) operated by the RBI from twenty-two offices across the country.

“To make the Ombudsman mechanism simpler, efficient and more responsive, it has been decided to integrate the three Ombudsman schemes and introduce centralised processing of grievances following a ‘One Nation One Ombudsman’ approach,” Das said.

“This is intended to make the process of redress of grievances easier by enabling the customers to register their complaints under the integrated scheme, with one centralised reference point,” Das added. The Integrated Ombudsman Scheme will be rolled out in June 2021.

Separately, the central bank is also working with major payment system operators on setting up of a 24*7 customer helpline for raising awareness responding to queries. The proposed helpline, expected to go live by September 2021, could later be used for lodging complaints pertaining to digital payments as well, Das said.

“…major payment system operators would be required to facilitate setting-up of a centralised industry-wide 24×7 helpline for addressing customer queries in respect of various digital payment products and give information on available grievance redress mechanisms,” said Das.

“Going forward, the facility of redress of customer grievances through the helpline shall be considered,” he added.

The RBI Governor also hinted at a detailed framework for the outsourcing of payment systems to third-party players with a view of tightening monitoring and supervision standards while also reducing operational risks in the digital payment ecosystem.

“The resilience of the digital payments ecosystem to operational risks needs to be constantly upgraded. A potential area of operational risk is associated with outsourcing by payment system operators (PSOs) and participants of authorised payment systems,” Das said.

The measure comes on the back of a string of high-profile cybersecurity attacks – such as the JusPay breach — on banking channels that has led to leak of millions and millions of sensitive customer information on the dark web.

“To manage the attendant risks in outsourcing and ensure that a code of conduct is adhered to while outsourcing payment and settlement related services, the Reserve Bank shall issue guidelines on outsourcing of such services by these entities,” Das added.